Best Trading Terminals for Active Traders & Investors: Interactive Brokers vs Saxo Bank vs eToro

- Sanzhi Kobzhan

- Jul 21

- 13 min read

Table of contents:

Investors and active traders know that having the right trading platform can make all the difference. In this article, we compare three of the best trading terminals for investors – Interactive Brokers, Saxo Bank, and eToro – to see how they stack up for active traders, long-term investors, and retail traders. We’ll examine key factors like pricing (commissions and fees), platform tools, speed and execution quality, research and news features, and overall usability (including mobile apps). By understanding the strengths and weaknesses of these top platforms, you can choose a low-fee trading platform with fast execution and robust tools that fits your trading style.

Interactive Brokers – Low Fees and Advanced Tools for Professionals

Interactive Brokers (IBKR) is renowned for its ultra-low costs and institutional-grade platform. It’s often the go-to for active traders seeking low fee trading platforms with direct market access. IBKR offers Trader Workstation (TWS) – a powerful desktop platform – alongside web and mobile apps. Here’s how IBKR measures up on key factors:

Pros:

Ultra-low fees and commissions: Interactive Brokers offers some of the lowest trading costs in the industry. Stock trades are $0 for U.S. clients on IBKR Lite, while IBKR Pro uses a low per-share fee (around 0.05%). Overall, IBKR is among the lowest-cost brokers industry-wide, beating Saxo on fees.

Fast, high-quality execution: IBKR’s smart-routing system seeks the best prices across exchanges, resulting in fast execution and price improvement. It doesn’t rely on payment for order flow for IBKR Pro, ensuring fast execution stock broker quality.

Advanced trading platform and tools: The Trader Workstation provides professional-grade charting (150+ indicators) and customization options. In fact, IBKR is rated a top platform for advanced traders (5/5 stars in platform tools), offering features like algorithmic trading, API access, and comprehensive order types.

Global market access & research: Clients can trade on 135 markets in 33 countries (stocks, options, futures, forex, bonds, and more)– far more variety than most brokers. IBKR also provides extensive research resources, including real-time news feeds and fundamental data, plus a marketplace of 1,500+ third-party research services.

Robust mobile app: The IBKR mobile app (available for iPhone, Android, even Apple Watch) lets you trade on the go with nearly all the functionality of the desktop. It supports advanced orders, options trading, price alerts, and even live streaming quotes (and news) on mobile.

Cons:

Complex for beginners: The flip side of IBKR’s rich features is a steep learning curve. New users may find the Trader Workstation interface overwhelming or “less user-friendly” compared to simpler platforms. Setting up the platform and learning all the tools takes time and effort.

Customer service and onboarding: Account opening with IB can be tedious, with thorough documentation checks that take longer than some competitors. Funding your account may also be less convenient (IBKR has limited payment options – no credit/debit card funding. Customer support, while adequate, is reported to be slower or less responsive than Saxo’s premium service.

User interface quirks: The powerful TWS platform isn’t the slickest in design – menus and settings can feel clunky or outdated. The web and mobile interfaces are more modern but still prioritize functionality over visual appeal, which might not suit casual investors looking for a simple experience.

Inactivity fees on some plans: While IBKR Lite has no inactivity fees, IBKR Pro (the plan with lowest commissions) previously charged a monthly inactivity fee for small accounts (this has been reduced/removed for many users but can depend on region). Also, some advanced market data or research tools may incur extra subscription fees if you choose to use them.

Bottom Line: Interactive Brokers is a top choice for experienced, active traders or globally-minded investors who demand low fees, fast execution, and advanced tools. It provides unparalleled market access and professional-grade analytics. However, it may be overkill for beginners who prefer a simpler interface. If you’re willing to navigate a complex platform to enjoy rock-bottom commissions and powerful capabilities, IBKR stands out as a premier trading terminal.

Saxo Bank – Premium Platform with Comprehensive Tools and Research

Saxo Bank offers a high-end trading experience through its SaxoTraderGO (web/mobile) and SaxoTraderPRO(desktop) platforms. It is often praised for a polished interface, extensive product range, and in-depth research – making it popular among advanced and long-term investors (especially outside the US). Let’s examine Saxo on key points:

Pros:

Immersive platform & brilliant research: Saxo’s platforms deliver a superb trading experience with a clean, professional interface and rich features. SaxoTraderGO (web) is easy to navigate yet packed with technical analysis tools, an extensive charting package, and customizable interface layouts. SaxoTraderPRO (desktop) adds even more advanced features for pros. The broker’s research offering is top-notch – Saxo provides daily expert commentary, trading signals, and fundamental data. In fact, Saxo is known for brilliant in-house research and market analysis integrated into the platform. For active traders, it offers an immersive, feature-rich environment with a towering selection of tools and premium features built-in.

Huge range of instruments: Saxo Bank stands out for its wide range of investable assets. You can trade over 70,000 instruments across stocks, ETFs, bonds, mutual funds, forex, commodities, options, CFDs, and more. This breadth is virtually unmatched, meaning even very diversified investors will find almost everything in one place.

Advanced trading tools: Saxo supports sophisticated order types (including algo orders and conditional orders) and risk management tools for professionals. Notably, SaxoTrader platforms integrate with TradingView charts, allowing you to use TradingView’s advanced charting and even Pine Script strategies directly with your Saxo account. Features like level II order books, options chains, and comprehensive portfolio analytics are available. SaxoTraderPRO is highly customizable with multi-screen support – ideal for day traders.

High-quality execution: As a premium broker, Saxo offers reliable and fast execution. It aggregates liquidity from multiple sources and even adjusts execution approach based on order size to get optimal pricing. This means even large orders can be executed efficiently (important for institutional or high-volume traders). Saxo does not engage in payment for order flow; instead it acts as a direct market access broker or principal depending on the product, aiming for best execution.

User-friendly mobile app: The SaxoTraderGO mobile app is very well-designed and mirrors much of the web platform’s functionality. It’s received a 5/5 rating in many reviews for its smooth user experience. You can swipe to trade, view interactive charts with technical indicators, read news, and manage your portfolio on the go with ease. Overall, Saxo’s focus on a quality user interface shines through on mobile.

Cons:

Higher fees (premium pricing): All this quality comes at a cost – Saxo’s trading fees are generally higher than discount brokers like IB. Commissions on stock trades, for example, might be around 0.1% (with minimum tickets, e.g. €10 in Europe) depending on the exchange. Saxo also charges foreign exchange conversion fees (~0.25%) when trading assets in a currency different from your account base. In short, Saxo’s fees are “higher than average” for many products, making it less ideal for very cost-sensitive traders or those placing frequent small trades.

Not available to U.S. residents: Saxo Bank does not operate in the United States. It’s a popular choice in Europe, Asia, and elsewhere, but U.S. investors cannot open Saxo accounts. These users would need to consider alternatives (like IB or others) due to regulatory reasons.

High minimums for premium tiers: While the basic Saxo account (Classic) has no or low minimum deposit, to unlock better pricing or VIP service, Saxo requires high balances (e.g. $200,000 for Platinum, $1 million for VIP). This won’t affect the average retail trader on a Classic account, but it means only very wealthy clients get the absolute lowest fees.

Some platform limitations: Despite its excellence, SaxoTrader isn’t perfect. For example, the PRO platform lacks pre-built “quick start” layouts for multi-monitor setups (users must configure from scratch). On SaxoTraderGO, you cannot drag-and-drop to modify orders directly on the chart (a feature some other platforms have). These are minor nitpicks, but active traders might notice such limitations. Additionally, Saxo’s myriad features can still overwhelm casual investors – the platform is simpler than IB’s, but it’s not as stripped-down as something like eToro or Robinhood.

Inactivity/Custody fee: In some regions, Saxo charges a quarterly custody fee or inactivity fee if you don’t meet a certain trading volume. For example, a custody fee of 0.25% annually (with a cap) might apply to hold stocks. This is another cost to be mindful of, particularly for long-term investors with inactive periods.

Bottom Line: Saxo Bank’s trading terminal is a premium solution best suited for experienced and serious investors who value a rich set of tools and are willing to pay a bit more for quality. Its polished platforms, stunning range of assets, and top-tier research make it ideal for active traders and wealthier investors who want an “all-in-one” brokerage. However, beginners or very cost-conscious traders might find the high fees hard to justify. If you want a professional-grade platform with excellent research and are not constrained by a tight budget – and if you reside in a region it serves – Saxo is a compelling choice for a trading terminal.

eToro – Easy, Social Trading with Commission-Free Stocks

eToro has emerged as one of the most popular trading platforms for retail investors, thanks to its zero-commission stock trading and innovative social trading features. Unlike IBKR and Saxo, eToro is designed to be extremely user-friendly – making investing feel as simple as using a smartphone app (which it literally is). Here’s how eToro compares on our criteria:

Pros:

Commission-free stock & ETF trades: eToro’s biggest draw is that it offers 0% commission on real stock and ETF trades for non-leveraged positions. In practice, that means when you buy stocks or ETFs on eToro (without using leverage), you pay no ticket fee – the pricing is very attractive for long-term investors. For example, eToro charges 0% commission on stock buys (they monetize via slightly wider spreads or FX conversion). By comparison, brokers like IBKR might charge 0.05% or more on certain international trades. This commission-free model (similar to Robinhood in the U.S.) makes eToro a low-cost choice for casual stock investors.

Easy-to-use platform and slick mobile app: eToro is often praised as one of the slickest investing apps available. The interface is clean, modern, and intuitive – suitable for beginners. Account opening is quick and fully digital, with a low minimum deposit (around $50 for many regions) and instant funding options. The mobile app mirrors all web functionalities, so you can trade, view charts, and even engage with the community on the go. Overall, eToro delivers a simplified, enjoyable user experience rather than bombarding you with complex terminals.

Innovative social trading features: What truly sets eToro apart is its social community and copy trading. Users can follow and interact with millions of other investors on the platform, seeing what others are trading and discussing. The CopyTrader feature allows you to automatically copy the trades of experienced investors – effectively, you can allocate some of your funds to mirror a “Popular Investor’s” portfolio. This unique social trading aspect helps newcomers learn from veterans and adds a collaborative dimension to investing. With over 25–30 million users worldwide on eToro, the community is vast. Social sentiment feeds, user portfolios, and discussion boards are integrated, making investing feel interactive.

Multi-asset offering (including crypto): Besides stocks and ETFs, eToro also lets you trade cryptocurrencies, commodities, indices, and forex (mostly via CFDs in certain regions). You can buy popular cryptos like Bitcoin and Ethereum directly on eToro with a user-friendly interface, which is a plus for those who want to dabble in multiple asset classes within one app. There are also thematic portfolios and copy portfolios (managed baskets) that provide diversified investment options.

No-frills research and education: eToro provides basic stock research info (price charts, some key stats, and an updated news feed for each asset). They also have a “News Feed” where the community posts insights. For education, eToro offers a variety of guides, webinars, and a virtual $100k demo account for paper trading. While not as in-depth as IB or Saxo, these resources are sufficient for beginner to intermediate investors to get started.

Cons:

Limited advanced tools and analytics: eToro’s simplicity comes at the cost of advanced functionality. The charting tools, while decent (with dozens of indicators and drawing tools), are not as comprehensive as those on Interactive Brokers or Saxo. For instance, eToro’s platform offers ~46 technical indicators vs. 155+ on IBKR. You also can’t deeply customize the interface or use features like programmable hotkeys, custom scripts, or algorithmic trading on eToro. In short, technical traders may find eToro lacking – it’s geared more towards basic analysis and long-term investing than high-frequency trading or complex strategies.

Spread and currency fees: Although stock trades are commission-free, eToro makes money through slightly higher spreads (especially on CFDs and crypto) and through currency conversion fees. All eToro accounts are in USD; if you deposit in another currency, there’s a conversion fee (~0.5%). Likewise, when trading non-USD assets, currency conversion spreads apply. These indirect costs mean active traders (especially in forex/CFD) might actually pay more in spread mark-ups compared to a broker with direct commissions. For example, EUR/USD spreads on eToro are about 1 pip, which is wider than some competitors. Crypto trades incur about a 1% fee (built into the price). So while casual stock investors won’t feel it, more sophisticated traders should note eToro’s *“free” trades aren’t completely free of all costs.

Non-trading fees (withdrawal, inactivity): eToro charges a $5 withdrawal fee on each withdrawal of funds (though in the US this may be waived). There’s also an inactivity fee of $10 per month if you don’t log in for 12 months. These fees are relatively small, but they can annoy users – many traditional brokers have done away with such fees.

No direct ownership in some cases & limited product scope: Outside of stock investing, many of eToro’s markets are offered via CFDs (Contracts for Difference) rather than direct ownership. For example, if you “sell” a stock (short it) or trade a stock on leverage, you’re using a CFD. eToro does not offer certain asset classes at all – you can’t trade individual options or futures, nor can you buy bonds or mutual funds on eToro. It’s primarily focused on stocks, ETFs, crypto, and CFDs on other markets. Additionally, eToro is not available in every country or U.S. state (regulatory restrictions apply in some jurisdictions).

Customer support & reliability for heavy use: eToro’s rapid growth has at times led to customer service lagging; some users report slow response times from support. The platform is stable for normal use, but during periods of extreme market volatility (e.g. meme stock frenzy), there have been instances of minor outages or restrictions (as with many brokerages). Serious day traders might be concerned about these issues, although for the average user eToro is generally reliable.

Bottom Line: eToro is fantastic for beginner and retail investors who want an easy, engaging way to invest in stocks (and dabble in crypto) without paying commissions. Its social trading aspect and simple interface make investing approachable and even fun, which is a huge plus for those just starting out. Long-term investors can buy stocks with zero commissions and leverage the wisdom of the crowd via CopyTrading. However, if you require advanced trading terminals or ultra-fast execution, eToro likely isn’t for you – it’s not as sophisticated in terms of tools or direct market access. In summary, eToro shines as a user-friendly, low-cost platform for casual trading and idea discovery, but more demanding traders might outgrow its capabilities.

Find Winning Stocks with the Stocks 2 Buy App for iPhone

While a great trading terminal helps you execute trades, having the right trade ideas and timing is just as important. This is where the Stocks 2 Buy iOS app comes in – it’s a powerful stock analysis app for iPhone that helps users find strong investment ideas and identify the best time to trade. The app provides a suite of intelligent tools that analyze stocks from multiple angles (fundamental, technical, and sentiment) in real-time. Here’s a look at its key features and how they can benefit you:

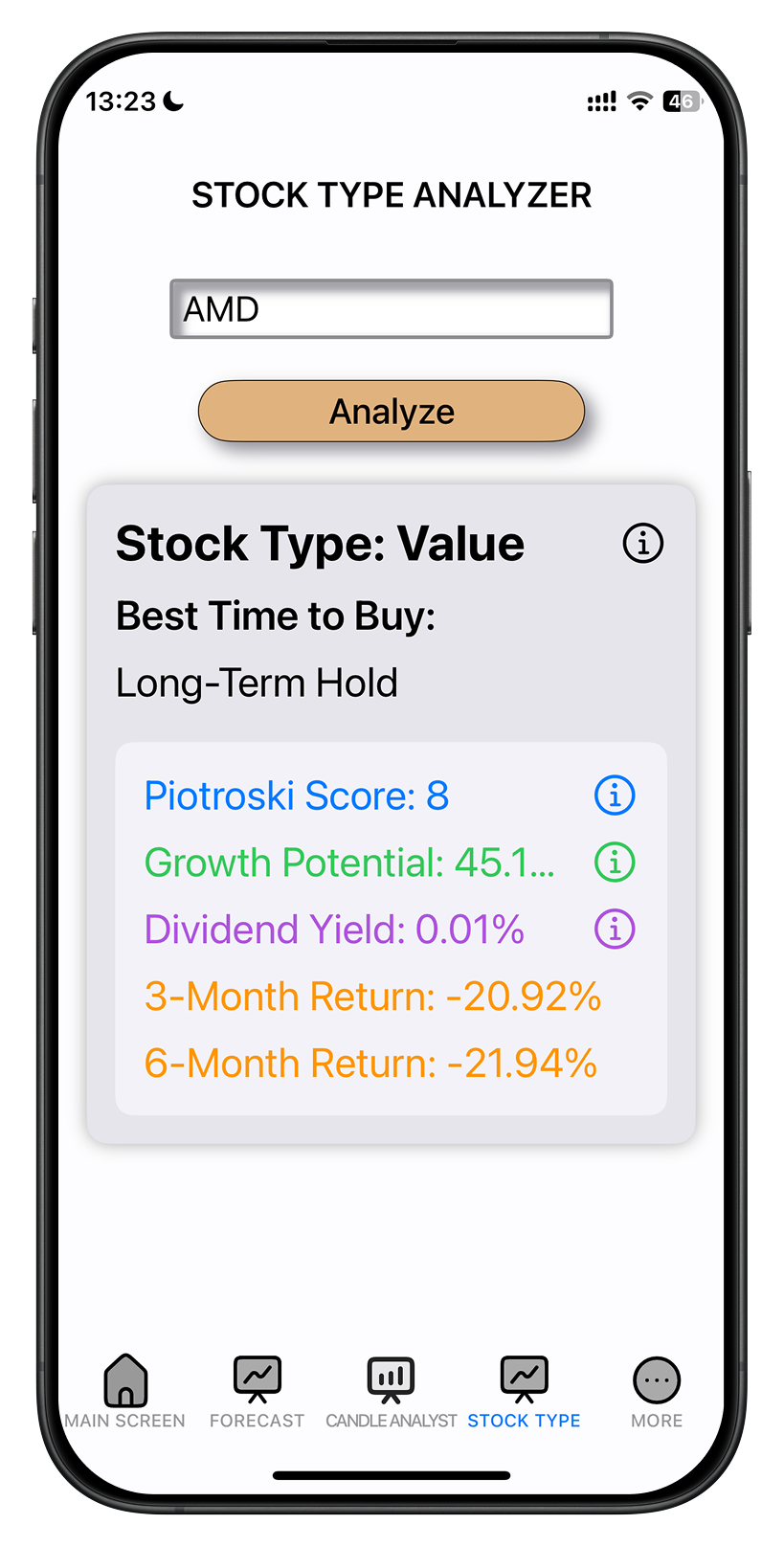

Stock Type Screen: This feature classifies each stock as a value, growth, or income type at a glance. It dives into fundamentals by providing the stock’s Piotroski F-score (a measure of financial strength and quality) and an estimated growth potential derived from a Discounted Cash Flow (DCF) model. Income investors will appreciate seeing the dividend yield, while all users can review recent return trends to gauge momentum. By synthesizing these indicators, the Stock Type Screen essentially tells you what kind of stock you’re looking at and whether it’s fundamentally strong. It even suggests when it might be the best time to buy – for example, if a high-quality value stock’s recent returns are down and it appears undervalued, that could signal a buying opportunity. This screen helps you decide if a stock fits your strategy (e.g. a value play vs. a high-growth bet) and if its current price looks attractive relative to its fundamentals.

Candle Analyst Screen: Active traders will love this tool – it analyzes intraday price action using Japanese candlestick patterns and updates every 5 minutes. The Candle Analyst automatically detects classic candlestick signals (like a Bearish Engulfing, Shooting Star, Hammer, etc.) on the stock’s chart throughout the trading day. It then interprets these patterns to indicate the short-term trend direction. For instance, if it spots a bearish reversal pattern, the screen might show a downward arrow or a red signal indicating the short-term trend is turning down. Conversely, bullish patterns yield an upward indication. This feature essentially acts as your personal technical analyst, digesting complex candle charts into simple signals (up or down) in real time. It helps you quickly answer, “What’s the market’s mood right now for this stock?” so you can time your entries and exits better. By leveraging candlestick insights – which many day traders use for predicting immediate price moves – the Candle Analyst Screen gives you a short-term trading edge without having to stare at charts all day.

Main Screen: The main screen of Stocks 2 Buy provides a mid-term trade recommendation for each stock – specifically a clear tag to “Buy”, “Sell”, or “Hold”. This recommendation is generated by the app’s intelligent algorithms, which combine several important signals:

EPS Surprise: The app looks at recent earnings reports and measures the surprise factor (how much actual earnings beat or missed analysts’ expectations). A big earnings beat can be a bullish sign, while a miss might be bearish. This factor helps gauge fundamental momentum.

Equity Rating: This aggregates the sentiment of Wall Street analysts on the stock (akin to a consensus rating). If analysts are largely bullish (upgrading the stock or setting higher price targets), the equity rating component will tilt positive, and vice versa. It’s a quick way to incorporate expert opinions and research into the decision.

Social Sentiment: Stocks 2 Buy also tracks investor chatter – what the crowd is saying on social media or other platforms. A positive social sentiment (above 0.5), or negative sentiment (below 0.5) can often foreshadow short-term moves, especially for momentum-driven stocks. The app quantifies this “hive mind” input as part of its recommendation.

By fusing earnings data, professional analyst sentiment, and real-time crowd sentiment, the Main Screen’s algorithm arrives at an easy-to-understand call: buy, sell, or hold. This saves you the time of separately researching earnings results, reading analyst reports, or gauging Reddit/twitter sentiment – the app does it for you. The Main Screen gives an overall verdict on a stock’s outlook in the mid-term, helping you prioritize which stocks are worth considering now and which might be riskier. Think of it as a second opinion or a starting point for deeper research: if a stock flashes “Buy” due to strong earnings and upbeat sentiment all around, you might investigate further or act on it; if it says “Sell”, you may decide to avoid or tighten your stop-loss on that position.

By combining these features, Stocks 2 Buy acts as a smart stock-picking assistant. It tells you what to buy (by highlighting fundamentally solid stocks with the Stock Type Screen), when to buy (by analyzing timing via candlesticks in the Candle Analyst), and why (by summarizing the bull vs. bear case on the Main Screen with fundamentals and sentiment). It’s like having a team of analysts in your pocket – all packaged in a simple app interface.

I hope my review was useful and you can choose a great trading terminal and use the Stocks 2 buy app as your trading advisor, investment analyst, and a valuable companion. Happy trading!

Comments